The VAT rate of the destination country is applied on the invoice (exception: triangulation transactions).

VAT is paid in the country where the consumption of goods and services takes place. A business that delivers goods to a business in another EU member state is generally exempt from VAT. However, there are documentation and reporting obligations associated with this.

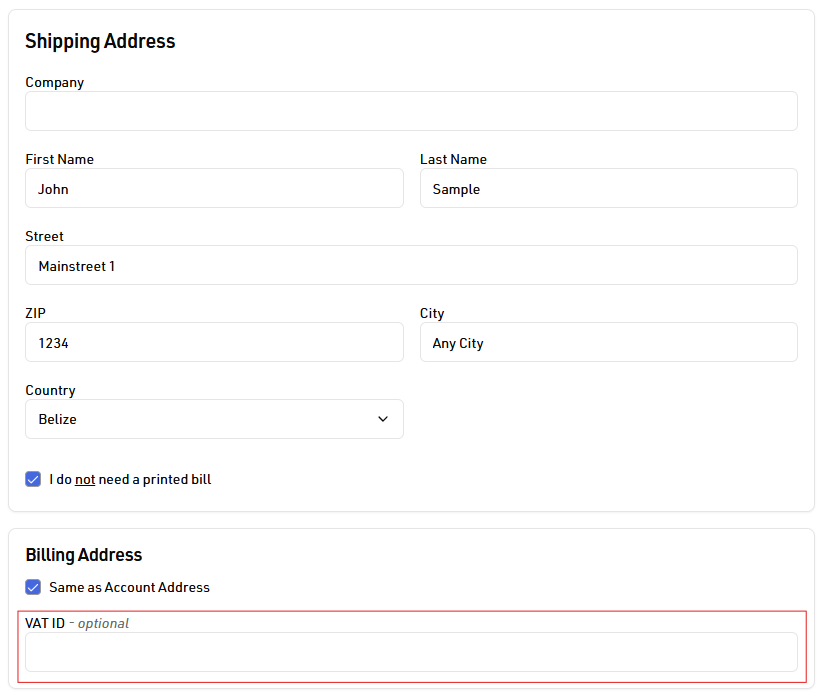

Please enter the valid VAT ID of the invoice recipient in the designated field in the billing address section.

Alternatively, you can save your VAT ID in advance in your customer account under "Your Data" so it is automatically applied to future orders. As soon as you enter a different invoice recipient, the VAT ID must be updated accordingly.

Please note that we can only consider a VAT ID for tax-free invoicing if it is correctly provided at the time of the order.

We kindly ask for your understanding that we cannot retroactively adjust invoices that have already been issued and paid if a valid VAT ID was not available at the time of the order.